From July 1 2021 through September 15 2021. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

Student Loan Debt Crisis In America By The Numbers Educationdata Org

See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program.

. Pay Off Your Tax Bill with Minimal Effort. Ad Rates as Low as 499 APR. For help with Federal Student Loans call the Student Loan Relief Helpline at 1-888-906-3065.

January 16 2020 by Ed Zollars CPA. Provide partial debt cancellation for each borrower with household. CALL STUDENT LOAN RELIEF HELPLINE.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Maryland taxpayers who have. The IRS announced an expansion of relief to additional individuals.

Instructions are at the end of this application. Ad Use Chipper To Explore Income Driven Plans and Forgiveness Options For Your FedLoan Loans. Student Loan Debt Relief Tax Credit for Tax Year 2020.

Complete the Student Loan Debt Relief Tax Credit application. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The original coronavirus relief bill known as the CARES Act and signed into law on March 27 2020 helped most federal student loan borrowers by temporarily pausing payments.

Ad Learn how we can help with Student Loan Forgiveness. File Maryland State Income Taxes for the 2019 year. AnswerThe tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

If the credit is more than the taxes you would otherwise owe you will receive a tax. Will have maintained residency within the state of Maryland for the 2020 tax year Have. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. For Maryland Residents or Part-year Residents Tax Year 2020 Only. They will review your case evaluate your options for switching repayment plans.

Payments as low a 0-5 per month. Pay Off Your Tax Bill with Minimal Effort. Incurred at least 20000 in total student loan debt.

To qualify for the Student Loan Debt Relief Tax Credit you must. Student Loan Debt Relief Tax Credit Application. If the credit is more than the taxes you would otherwise owe you will receive a tax.

Student Loan Debt Relief Tax Credit for Tax Year 2021. Check with your loan provider for information on relief for debt payment during the COVID-19 pandemic. These deferred payments dont necessarily apply to private student loans.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases. Pay Off Your Tax Bill with a PenFed Personal Loan.

Under the new law no payments are required on federal student. Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. More organizations have begun offering student loan debt assistance to their employees whether through information.

Pay Off Your Tax Bill with a PenFed Personal Loan. We can help with the confusion around Federal Financial Aid Forgiveness. Ad Rates as Low as 499 APR.

Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act.

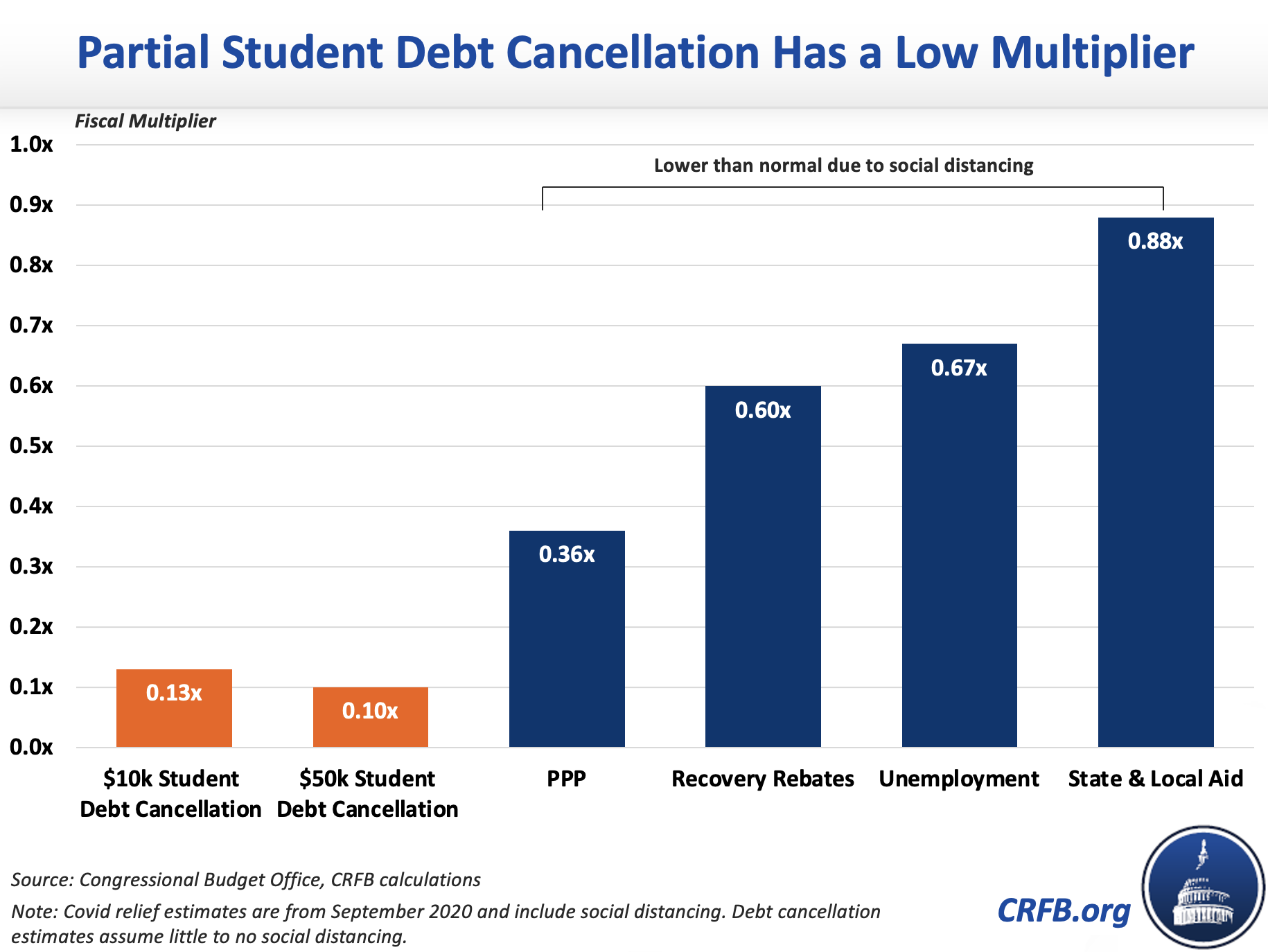

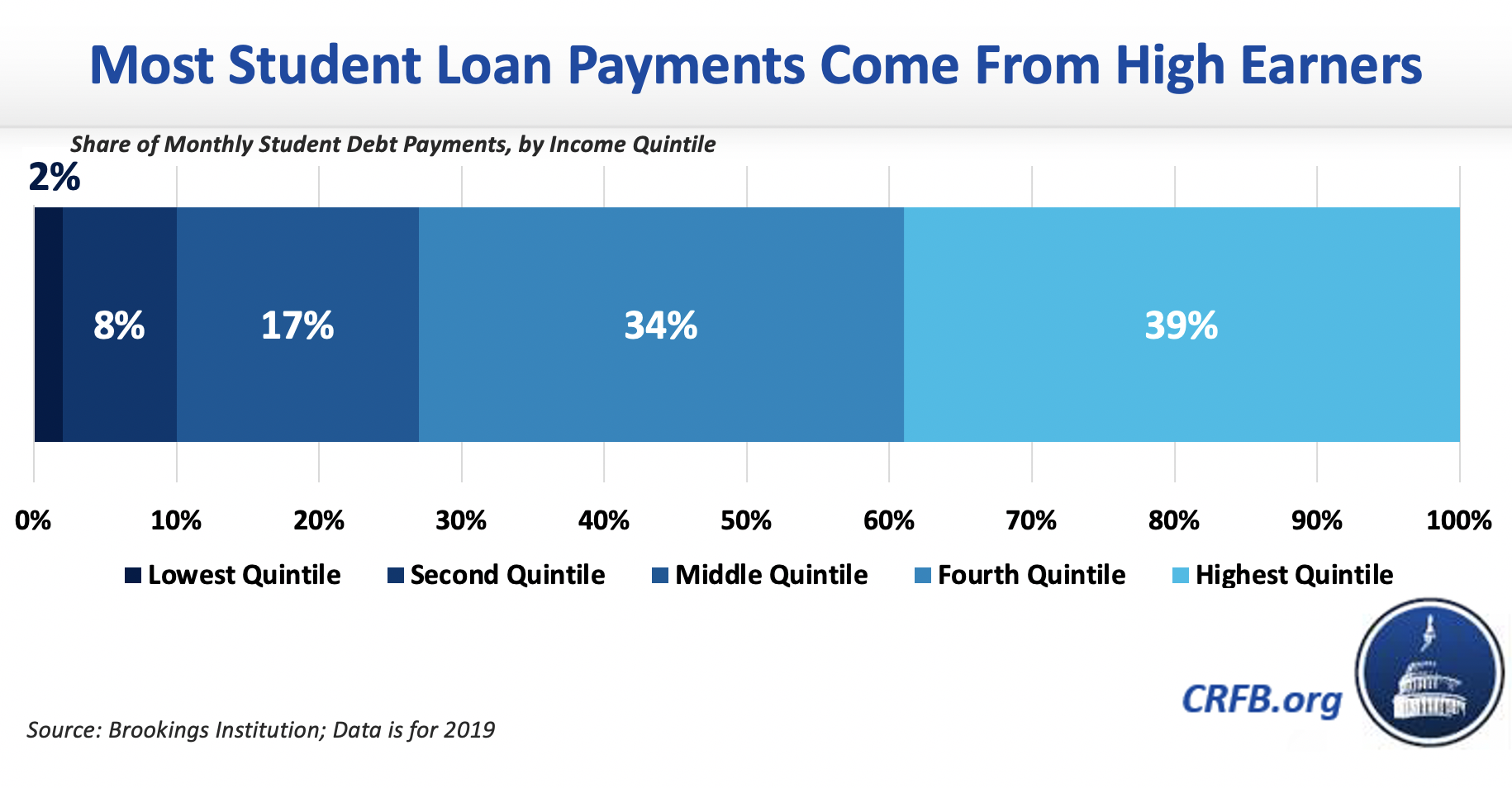

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

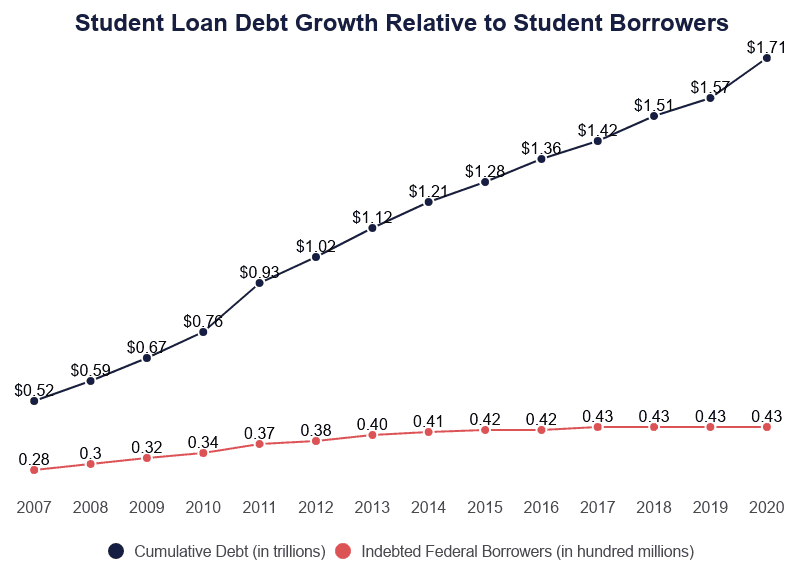

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

What Is The Current Student Debt Situation People S Policy Project

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Chart Americans Owe 1 7 Trillion In Student Loans Statista

The Real Cost Of Biden S Student Loan Plan Is 2 9 Trillion Student Loan Planner

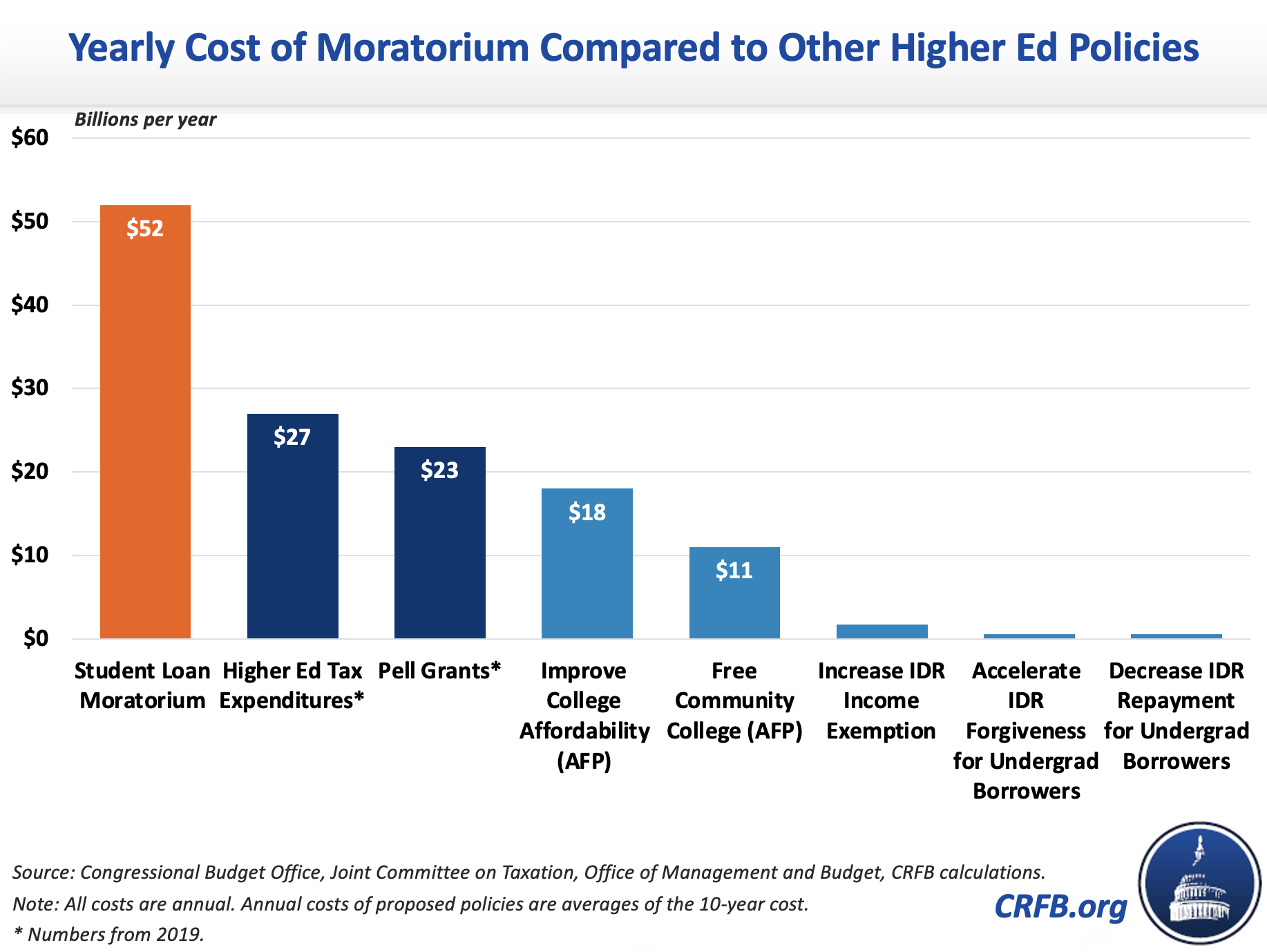

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2022 Pslf Data

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Learn How The Student Loan Interest Deduction Works

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero